operating cash flow ratio importance

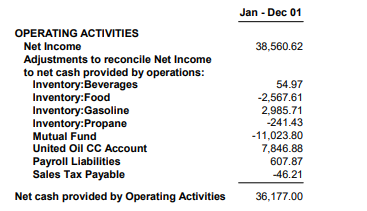

The current liability coverage ratio also called the cash current debt. The formula determines the amount of cash needed to cover expenses.

Cash Flow Ratios Accounting Play

Current liability coverage ratio.

. The Importance of Operating Cash Flow Operating cash flow is a financial metric that is often used to gauge the investment potential of a company. In an ideal situation when sales revenue increases cash flow should. The operating cash flow ratio is a formula used to analyze a commercial businesss cash flow.

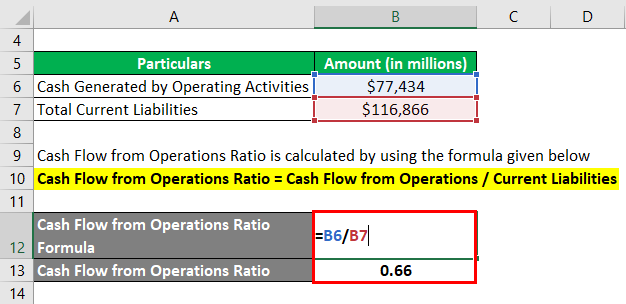

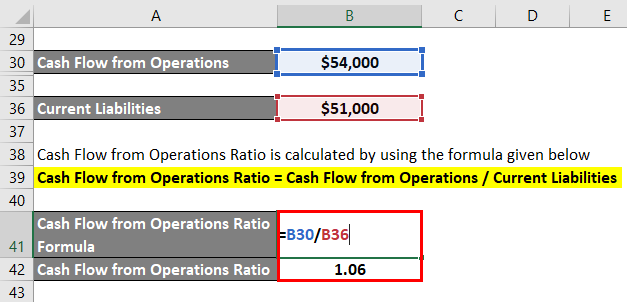

The operating cash flow to sales ratio is a popular metric used to compare current cash flow against sales revenue. Operating cash flow ratio helps you measure a companys liquidity by determining how capable it is to cover liabilities by the money it is making from its primary operations. This ratio can help gauge a.

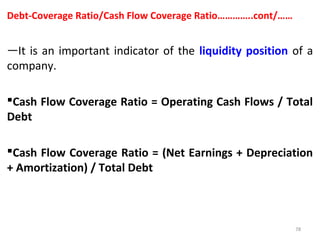

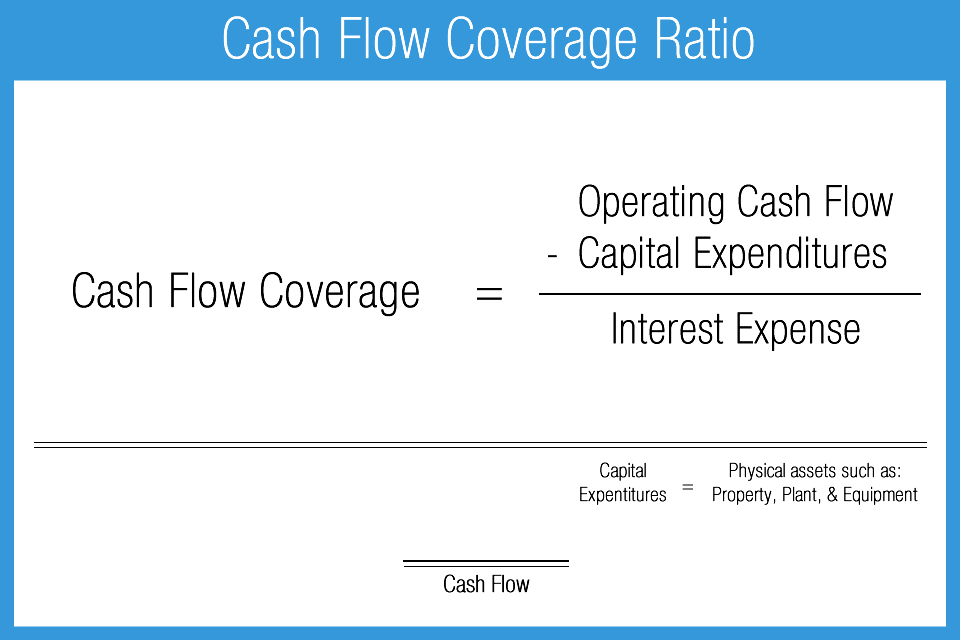

The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Now let us put the figure of Operating Income so derived in the formula to calculate this ratio. Why are cash flow ratios important.

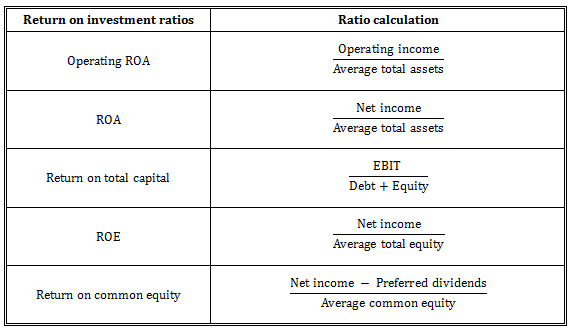

If this ratio increases over. Cash flow ratios are financial ratios in which either the numerator or the denominator or both is a cash flow figure. Important cash flow ratios include cash flow per.

Although there is no one-size-fits-all ideal ratio for every company out there as a general rule the higher the Operating Cash Flow Margin the better. One important thing to remember when calculating any of these cash flow ratios is that its important to compare your. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations.

It would serve a business owner. The operating cash flow of a company. We use the cash flow ratio to determine the companys overall financial performance.

Cash flow ratios are sometimes reserved for advanced financial analysis. Operating Cash Flow Ratio Operating cash flowCurrent liabilities. Here are six types of cash flow ratios common in financial analyses.

The operating cash flow ratio is a measurement that indicates whether the cash created from continuing operations is sufficient to pay for the current obligations your. In the case of a small business cash is very important for survival. For starters the operating cash flow ratio shows the overall health of your businesshow much money it has managed to accumulate from its basic activities.

For Year 3 -1100 450 -100 2400 1850 million. It has a few aspects. We can use several ratios to learn more about.

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Vs Profit What S The Difference Hbs Online

Cfa Level 1 Financial Ratios Sheet Analystprep Cfa Exams

Cash Flow Ratios Calculator Double Entry Bookkeeping

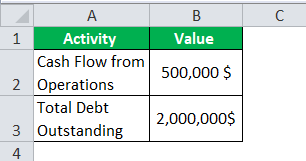

Price To Cash Flow Ratio Formula Example Calculation Analysis

Solved What Is The Operating Cash Flow Ratio And Cash Flow Chegg Com

Change In Working Capital Video Tutorial W Excel Download

Price To Cash Flow P Cf Formula And Calculator Step By Step

Constructing A Capital Budget Ag Decision Maker

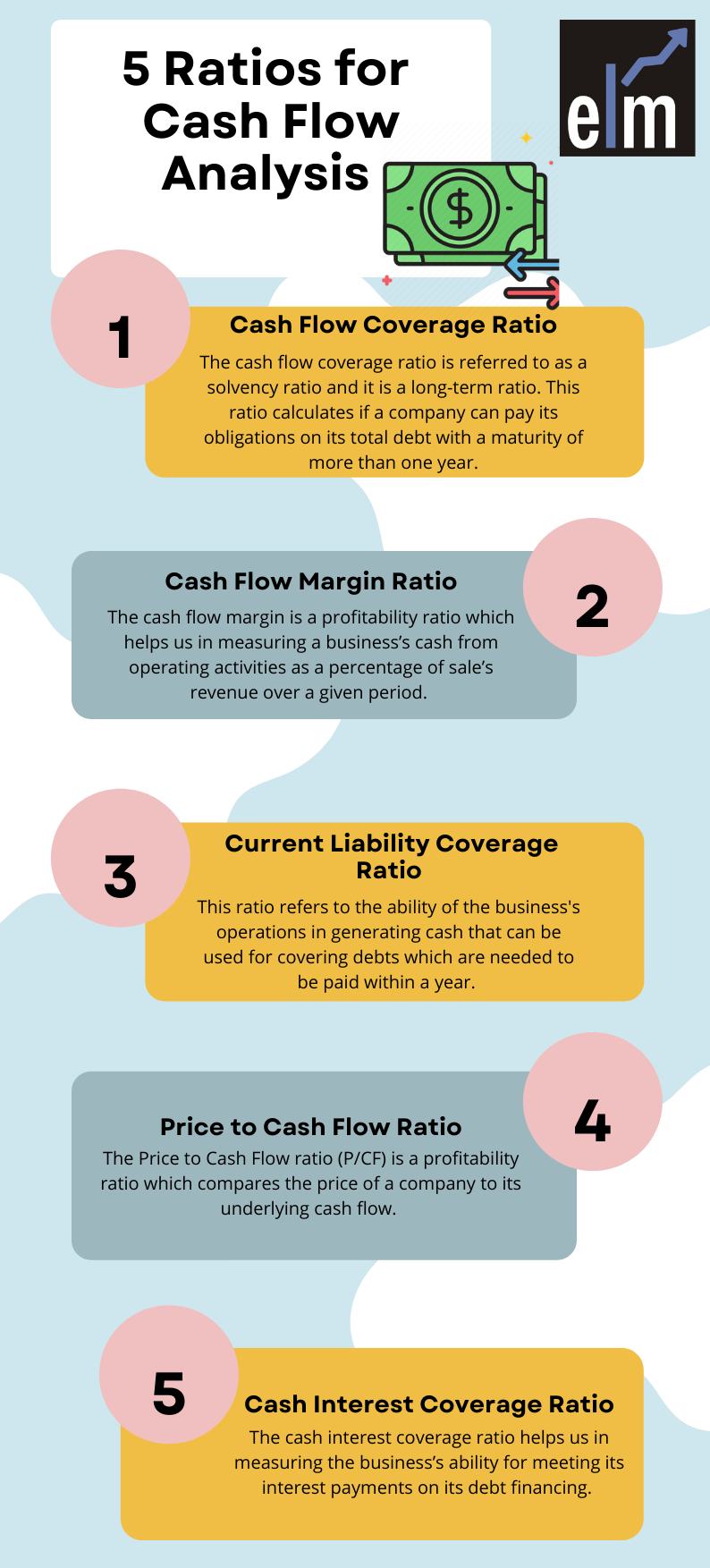

5 Important Ratios For Effective Cash Flow Analysis Elm

Efficacy Of The Dividend Cushion Ratio

Cash Conversion Ratio Financial Edge

Business Cash Flow Ratio And Value Evaluation Report Ppt Powerpoint Presentation File Example Pdf Powerpoint Templates

Cash Flow From Operations Ratio Formula Examples

5 Important Ratios For Effective Cash Flow Analysis Elm

Cash Flow From Operations Cfo Financial Edge